We are characterized by a comprehensive and professional service, providing care nationwide, in English and Spanish.

Taxes

Are you tired of feeling disorganized during tax time?

Or do you feel like you might be spending too much time on finance-related tasks?

To get the best service in planning and preparing your taxes, call us.

Tax Planning

- Tax planning is an important tool to optimize your financial situation and maximize your available resources. However, it is crucial to ensure that you comply with all applicable tax laws and avoid any activity that could be considered tax evasion.

Tax preparation

- It is important to keep in mind that tax laws can change and tax preparation can be complicated, especially in more complex financial situations.

- Enjoy a stress-free tax season with our team of dedicated tax professionals, focused on keeping you in compliance with the laws while maximizing your tax savings. No more extensions, taxes well paid and on time.

Your taxes in the hands of experts

- Personal Taxes

- business taxes

- Tax representation (Special cases)

Scrambling at the last second to gather documents for tax season is stressful, and rushing accounting-related tasks can leave you vulnerable to compliance issues and missed growth opportunities. Fortunately, good planning reduces your tax burden by preparing ahead of time and planning your taxes for maximum benefit.

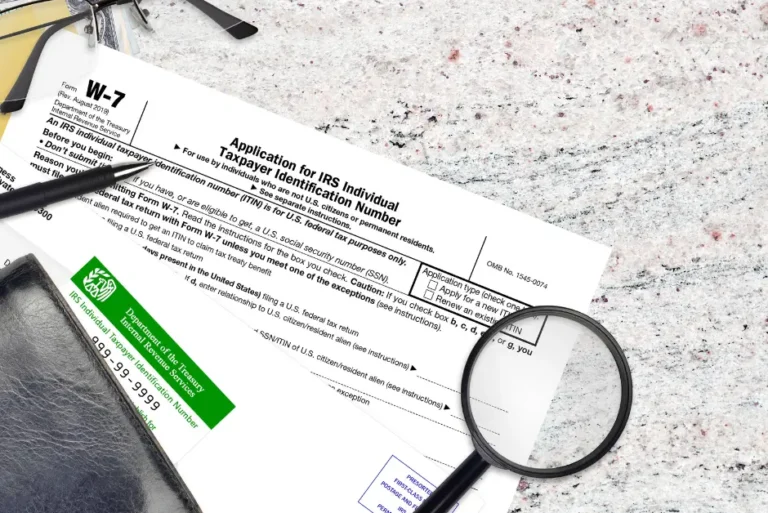

Creation or renewal of ITIN

The ITIN, which stands for “Individual Taxpayer Identification Number”, is a tax identification number issued by the United States Internal Revenue Service (IRS) to individuals who are not eligible to obtain a Social Security number, but who need to file taxes in the United States.

It is important to keep in mind that the ITIN must be renewed periodically.

We are a company authorized, trained and certified by the IRS to help you with the management of your ITIN.

We specialize in business tax and advice, in addition to offering informative workshops.

Visit Leaders to learn more about our workshops.

Open all year long! We work with virtual and in-person appointments.

We are Ready to Serve You!